Kicking Off the Center of Responsible AI and Finance

Researchers from Columbia University and Capital One inaugurated CAIRFI, a new center at Columbia Engineering aimed at advancing responsible AI for the financial sector.

More than 50 researchers from Capital One and Columbia University gathered at the Manhattanville campus on March 28 to inaugurate the Center for AI and Responsible Financial Innovation (CAIRFI), a partnership between Capital One and Columbia Engineering to foster research, education, and the responsible advancement of state-of-the-art AI in financial services. In a series of lightning talks and roundtable discussions, research leaders from both organizations discussed the challenges and opportunities the new technologies present, driven both by theoretical advancement and business use cases.

Garud Iyengar, senior vice dean of research and academic programs at Columbia Engineering, welcomed the attendees, noting that CAIRFI’s task is of vital and urgent importance.

“It is crucial for the success of artificial intelligence — and for the success of our society — to advance basic research in this technology while ensuring that it is secure, fair, transparent, responsible, and potentially regulatable, at least in the context of financial services,” said Iyengar, the Tang Family Professor in the Department of Industrial Engineering and Operations Research.

Prem Natarajan, Capital One’s Chief Scientist and Head of Enterprise AI, noted that CAIRFI is the newest venture between his company and Columbia University, which have been partnering for more than a decade. In keeping with Capital One’s founding tradition of using quantitative analysis to help improve the financial lives of millions of customers, the new center will allow the company to “continue addressing the hardest problems” in AI and finance, like expanding access and offering greater personalization of products and services.

“In the financial world, AI brings with it many task-oriented challenges,” he said. For example, where computer scientists are interested in the explainability of AI models from a theoretical perspective, most of the 100 million customers Capital One serves are more interested in understanding how models use their information to make important decisions. For Natarajan, this should excite researchers. “Studies focused on customer-driven problems might drive advances and sharpen our thinking,” he said.

Shih-Fu Chang, Dean of Columbia Engineering and Morris A. and Alma Schapiro Professor of Engineering, as well as a professor in the Departments of Computer Science and Electrical Engineering, underscored the timeliness of the partnership, noting that AI is one of the three priority areas recently outlined by University President Minouche Shafik.

“As we know, AI is unlocking tremendous opportunities for financial innovation, making it more important than ever to address issues of transparency, flexibility, security, and protections,” he said. “I’d like to thank Capital One for joining us on this timely endeavor."

Lightning Talks

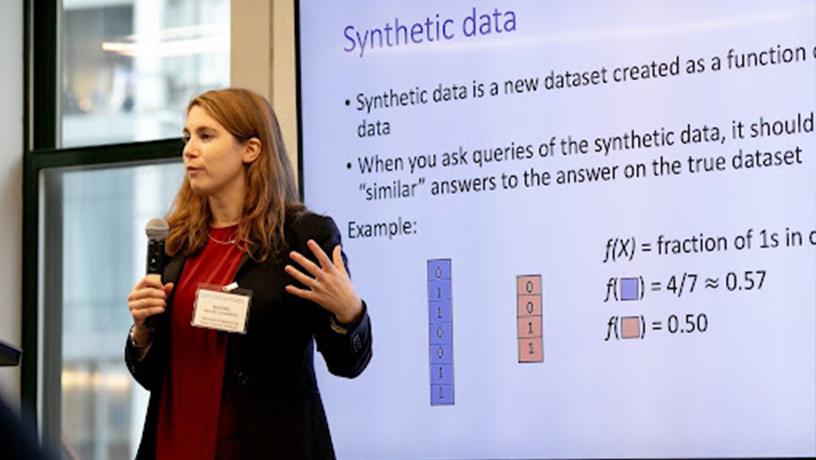

Rachel Cummings, associate professor of engineering and operations research at Columbia Engineering, described her work to protect privacy and data security by generating synthetic datasets that share the same statistical profile as the original data.

Doron Bergman, distinguished machine learning fellow at Capital One, described his team’s search for deep learning methods capable of outperforming tree-based models in analyzing tabular data.

Richard Zemel, Trianthe Dakolias Professor of Engineering and Applied Science in the computer science department at Columbia Engineering and director of the NSF Institute for Artificial and Natural Intelligence (ARNI), described his work developing a framework for responsibly deploying AI systems, with an emphasis on the auditing and decision-making stages of the deployment pipeline.

Sambit Sahu, vice president of applied research at Capital One and adjunct associate professor in the computer science department at Columbia Engineering, discussed the promise of smaller models in the context of his research group’s work in large language model pre-training, core model fine-tuning, and inference optimizations at Capital One.

Senthil Kumar, director of machine learning at Capital One AI Foundations, shared his group’s work using AI methods to solve pressing business problems and advancing other areas of research.

Paul Glasserman, Jack R. Anderson Professor of Business at Columbia Business School, described work eliminating look-ahead bias from backtesting in his research into using LLMs to predict stock prices.